After university officials announced that Ohio State is looking to privatize the management of its energy, it’s still unclear how any prospective management company or OSU might profit. Meanwhile, at least one expert said the initiative’s success will depend on the deal’s transparency, while another said he’s still not convinced it will save OSU money.

The plan

OSU officials announced to the University Senate Fiscal Committee Tuesday that it plans to enter into a long-term lease with a private company to manage its energy — including natural gas, electricity and water for heating and cooling. It’s calling the plan the Comprehensive Energy Management Initiative.

That company could turn a profit by helping OSU cut energy costs and make it more energy efficient, Provost and Executive Vice President Joseph Steinmetz told The Lantern on Wednesday.

Even so, when asked how that company might specifically profit, OSU spokesman Chris Davey didn’t have a direct response.

“Because this is a comprehensive approach to energy management, this partner would use its expertise in energy purchasing, delivery and management to meet our requirements for efficiency and affordable energy — while maintaining or improving service levels,” Davey said in a Sunday email.

The company would also fund — or partner with another entity to fund — and install energy conservation measures in buildings throughout campus, he said.

OSU currently spends $100 million annually on energy, senior vice president and chief financial officer Geoff Chatas told The Lantern on Wednesday. It also has about $250 million to $300 million worth of energy improvements that could be made, but haven’t because of a lack of funding.

The lease could allow OSU to put that money back into the university, including through scholarships and internships, Chatas said.

When asked how much of the potential savings might go back into the university, Davey said officials probably wouldn’t know until mid-2015, when the OSU Board of Trustees is set to approve the plan.

“Until we explore all these variables, it is difficult to even speculate on a total dollar amount,” he said.

But before then, OSU would spend the early part of 2015 assessing which companies might be fit for the job, Chatas said. Bidding could then start as early as next fall. The duration of the lease and the amount OSU might save depends on what the companies propose.

The initiative is something OSU President Michael Drake said is in line with the university’s vision for long-term sustainability.

“Among the things that are most important for us to do are to have policies that are sustainable … that we can use to help show the world how it ought to be done,” Drake said during a Thursday address to University Senate. “It’s something that I’ve been committed to for many, many years.”

Experts weigh in

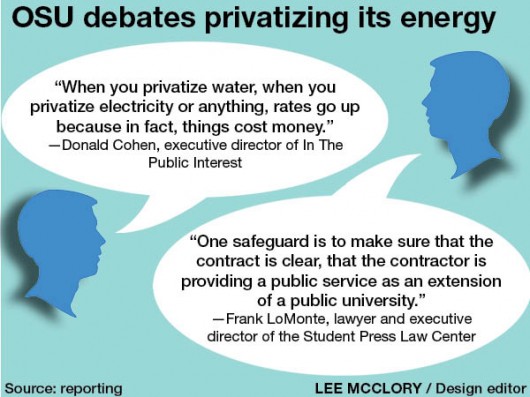

Donald Cohen, executive director of In The Public Interest — a Washington, D.C.-based resource center aimed at ensuring transparency for public contracts with private entities — said he’s somewhat skeptical that OSU would actually be saving money over the lifetime of the investment.

“When you use private money instead of public money, private money is quite a bit more expensive,” he said. “When you privatize water, when you privatize electricity or anything, rates go up because in fact, things cost money. It’s sort of that simple.”

Cohen said he’s skeptical that OSU would really save that much over the lifetime of the investment, rather than just doing the upgrades themselves.

“You’re making a big investment in infrastructure so you just can’t measure today,” he said. “You have to measure the whole period of time. If I didn’t have to buy my house, I could have done all sorts of things.”

Meanwhile, one lawyer said that while the idea of leasing OSU’s energy might not be all that bad, it’s important that the university remains transparent in the deal and maintains plenty of oversight.

“There’s always a downside risk to privatization that the public is going to lose its ability to effectively monitor how their money is being spent and how their services are being delivered,” said Frank LoMonte, a lawyer and the executive director of the Student Press Law Center, a legal assistance agency that works with student journalists.

“One safeguard is to make sure that the contract is clear, that the contractor is providing a public service as an extension of a public university. When you’re acting as an arm of a state agency, then under Ohio law, you still have to open your books and be transparent.”

Davey did not immediately respond to an email on Friday asking what kind or level of oversight the university might provide in the deal to ensure transparency.

While The Lantern reached out to a variety of faculty members in an attempt to gauge their response to the deal, many did not answer or declined to comment.

A similar deal

The University of Oklahoma signed a 50-year contract in 2010 for energy management with Corix Utilities Inc., which will save the university an estimated $38 million to $66 million during the life of the contract.

The deal will allow the university’s leadership team to focus its time and resources on delivering OU’s academic responsibilities, said Daniel Pullin, dean of Oklahoma’s Michael F. Price College of Business.

“We benefit from the private operator’s expertise gleaned from their other installations, which allows them to use best-practices in providing a high-quality, cost-effective service,” Pullin said in a Friday email.

Still, Pullin said there was at least one hurdle with the lease.

“A primary challenge was getting comfortable that the transition of a historically in-house function would result in the service level consistency required for the university to fulfill its primary purpose of creating and disseminating knowledge to prepare leaders for the nation and world,” he said.

Job creation/loss

While Steinmetz said it’s still too early to know if the lease might result in an addition or reduction in jobs, Davey said it’s also too soon to speculate whether or where OSU might see this employment shift.

“At this point, all we can do is acknowledge the possibility of some impact,” he said.

Even so, Cohen said it’s quite possible that the deal could result in job reduction or jobs being transferred to the private company, which could potentially offer less compensation and fewer benefits.

“I don’t know if that’s what they’re planning, but that’s typically what happens and that hurts us all,” he said.

However, job reduction or lost wages wasn’t the case for Oklahoma, Pullin said.

Oklahoma utilities employees were offered “substantially similar” positions with the private sector provider, he said.

“I do recall that virtually every former OU employee that was offered a role with the private operator accepted that offer,” Pullin said. “This speaks to the competitiveness of their compensation.”

Corix Utilities Inc. did not respond to a Friday phone call requesting comment on the deal, including employee compensation.

Still, LoMonte said he’s not necessarily convinced.

“I think it’s quite commonplace that contracting out services to private vendors results in fewer people delivering the service,” he said. “Whenever you’re talking about a government service, the No. 1 expense involved is salary. And so if the privatization is really supposed to cost less, then delivering it in-house is going to mean lower personnel costs.”

Future plans for privatization

This isn’t the first time, and perhaps won’t be the last time, that OSU has sought to gain capital from privatization — something to which OSU’s last president once showed hesitation about for certain areas.

The university agreed to a 50-year lease on its parking assets for the upfront price of $483 million. QIC Global Infrastructure, an Australian investment firm, placed the bid and created CampusParc to operate the parking facilities. The deal was finalized and approved by the Board of Trustees in June 2012. That deal was criticized by people — including faculty — at the time and has been criticized since for the annual price increases it permits.

OSU also holds private contracts with other companies:

- Coca-Cola: a $32 million contract spanning 10 years that makes Coca-Cola the exclusive beverage vendor at OSU

- Nike: $46 million over 11 years that makes Nike the exclusive supplier of any athletic equipment used by OSU varsity athletes and gives the company licensing rights on OSU retail apparel

- Huntington: 15-year, $25 million contract that makes Huntington the official consumer bank of OSU

- Hat World Inc., doing business as Lids Sports Group: 10-year contract worth $12.05 million that gives the company, with J. America, the right to exclusively produce and sell university apparel

- J. America: 10-year, $85 million contract that gives the company, with Lids, the right to exclusively produce and sell university apparel

Steinmetz said he has no qualms about privatizing other things going forward.

“From my perspective, I don’t think anything should ever be off the table,” he said. “If there’s a way we can do it more efficiently, if there’s a way we can transfer the money that we’re overspending on something to support students in our academic mission, then that’s the academic officer in me coming out.”

Still, Steinmetz said there’s been little talk of privatizing anything else at the moment, and that current efforts, like privatizing utilities, are the university’s main focus right now.

“We’ll look at all things that are possible that may be out there — we haven’t looked at any of these in specific, like dining I’ve heard come up a couple of times — and that’s not something at this point that we’ve said, ‘Yeah, let’s go look at it,’” he said.

Even so, former OSU President E. Gordon Gee once also showed reservations about privatizing certain assets.

“Privatizing things like housing or dining … I think those are really core educational functions for the university,” Gee told The Lantern on March 25, 2013. “They would have to strap me to a log and send me down the Olentangy (River).”

Gee — who is now the president of West Virginia University — announced he was retiring from OSU days after controversial comments he made at a December 2012 OSU Athletic Council meeting came under public scrutiny.

Davey said the university will strive to be transparent during the process.

“We have had several conversations already with a variety of stakeholders including students, faculty and staff and expect these to continue throughout the process,” he said. “Differing opinions always are welcome during these discussions.”